BPI ANALYSIS: Boston's Mansion Markdown?

Investigating "vertical inequity," an issue that provides Boston's most expensive homes a discount on property taxes

A growing body of research has shown a national problem with property taxes: as the value of a property rises, property tax assessments do not rise proportionally, resulting in lower effective tax rates on higher valued homes. This phenomenon is called “vertical inequity.” This national problem is also afflicting property tax dependent communities in Massachusetts, including Boston. In 2023, the Lincoln Institute of Land Policy and the Center for Appraisal Research and Technology developed a tool called the “Vertical Equity App,” to help local governments determine whether this is happening in their assessments. Boston Policy Institute, Inc (BPI) used the tool to evaluate the City of Boston’s assessing data and found that the City’s assessments suffered from vertical inequity. BPI’s findings that there is evidence of vertical inequity in Boston is in line with other analysis of Boston’s assessing data. BPI’s review of current research shows that there are no easy solutions for this issue, and tackling it will require significantly more public engagement by Massachusetts’ public sector leaders.

WHAT IS VERTICAL INEQUITY?

The Lincoln Institute of Land Policy (LILP) defines vertical inequity as: “low-priced properties assessed at a higher percentage of market value than high-priced properties.”1

This is a particular problem in Massachusetts because local governments are both dependent on property taxes as their main source of revenue and many lack the capacity to implement measures that can combat vertical inequity. BPI is not the first organization to highlight this problem in Massachusetts. Earlier examples include:

In August 2016, Thomas PlaHovinsak, a PhD student in Applied Economics at Northeastern University, published his dissertation which focused in part of vertical inequity and found: “high-value properties across the state are the ones most likely to be under-assessed regardless of whether or not they are located in a high-income town.”2

In February 2020, the Massachusetts Budget & Policy Center produced a report on property taxes in the Commonwealth that found, “expensive homes tend to get assessed by tax authorities at less than their market price – and to greater extent than less expensive homes in the same jurisdiction.”3

In March 2024, Boston’s former Assessing Chief Ronald Rakow wrote a working paper for LILP titled “How Homestead Exemptions Can Counteract Regressivity in Property Tax Assessments,” with data from Boston and found that vertical inequity “may be an issue even when sound assessment practices are applied.”4

Research over the last decade has found that vertical inequity is a widespread problem for governments that collect property taxes and that the conventional measures of vertical inequity like the price-related differential fail to properly assess whether it is a problem for individual jurisdictions.

WHAT IS THE “VERTICAL EQUITY APP”?

With conventional measures of vertical inequity failing to properly assess the issue, LLILP commissioned work to find new measures that could solve that short-coming. The two people who they commissioned - Daniel McMillen and Ruchi Singh - are leading experts on vertical inequity. In an LILP working paper published in 2022, they proposed a number of additional measures that can show vertical inequity in property assessments.5

LILP used that research to create LILP’s Vertical Equity App (VEA), which gives assessors the ability to run their data through McMillen and Singh’s basket of measures and create easily understood charts showing the results.6 While the VEA is designed for use by local governments’ assessment offices, the data that assessors use is available to the public.

WHAT DOES THE APP SHOW ABOUT BOSTON’S DATA?

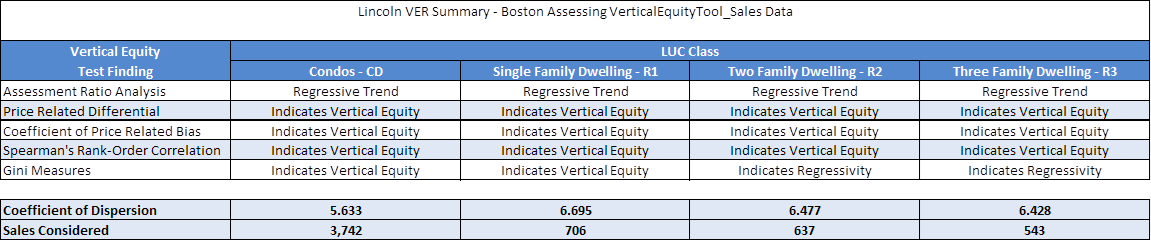

BPI used the Vertical Equity App to test for vertical inequity in four different categories of residential properties in Boston: Condos; Single Family Homes; Two Family Homes; and Three Family Homes.

BPI used the same data the City is required to submit annually to the Massachusetts Department of Revenue, and uploaded the data directly into LILP’s Vertical Equity App. The findings were that all four classes of property suffer from regressive assessments whereby the owners of lower-valued homes in Boston are paying property taxes on a higher percentage of their home’s value than the owners of higher-valued homes are paying.

The table below is the result of running that data through the VEA:

The VEA’s analysis concluded that both Condos and Single Family Homes in Boston are regressive based on one measure: the Assessment Ratio Analysis test. The Two Family Homes and Three Family Homes saw regressivity in two measures: the Assessment Ratio Analysis test and the Gini Measures. The takeaway from these results is that lower-valued properties across all four categories are being over-assessed compared to higher priced in all four categories.

These findings are consistent with another recent analysis of Boston’s property assessment by Boston’s former Assessing Chief Ron Rakow, who found a “concerning” amount of vertical inequity in Boston’s assessments.7

WHAT CAN BE DONE TO REDUCE OR ELIMINATE VERTICAL INEQUITY?

Research on vertical inequity is relatively new: all of the research that BPI reviewed has been produced in the last decade. That means that much of the focus has been on proving the existence of vertical inequity and much less on the list of options for dealing with that issue. The VEA is a good example of this: it is a tool to identify vertical inequity, but the analysis it produces does not include policy recommendations to correct it.

The most specific solution is found in Boston: the City’s homeowner exemption is an excellent tool for reducing the effects of vertical inequity. Research shows providing a homestead exemption - reducing property taxes - can negate the regressive effective tax rate that owners of lower-priced residential property would otherwise pay.8

The other solutions proposed fit into this broad recommendation from Yale Law Professor David Schleicher:9

“Fixing PTAR [Property Tax Assessment Regressivity] would be costly—it would require greater investigation into both individual properties and the economic value of location, more sophisticated modeling, a more well-resourced appeals process, and more frequent reassessments.”

All this points towards the need for much greater public engagement with vertical inequity by city and state authorities. That means hearings, blue-ribbon commissions, and ultimately legislation.

Boston Policy Institute, Inc is working to improve the public conversation - help us by following BPI on YouTube, TikTok, Facebook, Instagram, Threads, Twitter, and LinkedIn.

Lincoln Institute of Land Policy, "Lincoln Institute Vertical Equity App," accessed February 22, 2025, https://www.lincolninst.edu/data/lincoln-institute-vertical-equity-app/.

Thomas PlaHovinsak, Three Essays on Housing Policy and Inequality (Boston, MA: Northeastern University, 2016), p. 3, http://hdl.handle.net/2047/D202146.

Phineas Baxandall, “Making Property Taxes Progressive,” February 2020, Massachusetts Budget & Policy Center, Boston, MA, accessed February 22, 2025. p. 10. https://www.massbudget.org/reports/pdf/Making%20Property%20Taxes%20Progressive%20(long%20report).pdf.

Ronald Rakow, “How Homestead Exemptions Can Counteract Regressivity in Property Tax Assessments,” March 2024, Lincoln Institute of Land Policy, Cambridge, MA, accessed February 22, 2025. p. 10 https://www.lincolninst.edu/publications/working-papers/how-homestead-exemptions-counteract-regressivity-property-tax/.

Daniel P. McMillen & Ruchi Singh, “Measures of Vertical Inequality in Assessments,” Lincoln Institute of Land Policy, Cambridge, MA, accessed February 22, 2025. https://www.lincolninst.edu/publications/working-papers/measures-vertical-inequality-in-assessments/.

Lincoln Institute of Land Policy, "Lincoln Institute Vertical Equity App," accessed February 22, 2025, https://www.lincolninst.edu/data/lincoln-institute-vertical-equity-app/.

Rakow, “Homestead Exemption,” p. 5

Rakow, “Homestead Exemption,” p. 9

David Schleicher, “Your House Is Worth More Than They Think: The Strange Case of Property Tax Regressivity,” published February 22, 2025, Harvard Journal on Legislation, Cambridge, MA, accessed February 25, 2025, https://journals.law.harvard.edu/jol/2025/02/22/your-house-is-worth-more-than-they-think-the-strange-case-of-property-tax-regressivity/