Weekly Transcript Round-Up for 10/11/24: 3 Updates from Mayor Wu on Tax Hike; MCAS & Late Buses topic at School Cmte, on Radio & TV; 4 recent reports agree - housing costs are too high

This week saw three major updates on Mayor Wu’s push for a tax hike on Boston’s commercial property owners:

Boston’s released 2025’s estimated quarterly taxes for residential and commercial property owners;

Described the impact of cutting the budget instead of shifting taxes; and

Mayor Wu set a deadline for legislative action.

There were also updates on MCAS & late buses:

Boston Public Schools’ MCAS results were the focus of Wednesday’s School Committee meeting;

BPS late buses were one of the topic MA’s Education Secretary talked in a Sunday news show & the School Committee got a new update; and

Both the School Committee and Mayor Wu were asked to weigh in on Question 2 and declined.

Finally, in the last two weeks four think tanks released reports & held events that all had a common theme: the high cost of housing in MA. Check short summaries & links for the reports & events from Boston Indicators, Massachusetts Taxpayers Foundation, Pioneer Institute, and Massachusetts Budget & Policy Center.

MAYOR WU’S TAX HIKE GETS ESTIMATED TAXES & DEADLINE

This week saw Mayor Wu provide three important updates about her proposal to raise taxes on commercial property owners over the state-mandated limit in a press briefing on Wednesday morning and again at an invite-only zoom meeting with select members of the community. The same presentation appears to have been used in both calls:

Estimated quarterly taxes for both residential and commercial property owners that appeared prompted by Council action;

What action would need to happen if the budget was cut by the same amount that her proposal seeks to raise taxes on commercial property owners; and

Deadline set for state legislative action.

This presentation is the first time that City officials have offered numbers of their own. The often cited 33% tax increase that Mayor Wu used in radio appearances and testimony before the state legislature was not drawn from the City’s own analysis. Rather that number was taken from a report produced by the Boston Municipal Research Bureau, an outside group that administration officials have criticized in harsh terms over the last several months. Mayor Wu described where the 33% number came from during her testimony before the Joint Committee on Revenue back in July - watch the exchange with House Chair Mark Cusack here.

This presentation is also an implicit admission by Mayor Wu and her team that previous statements from the Wu administration arguing that Boston faced no budget issues from falling office values were wrong:

At last year’s tax rate setting hearing the City’s Assessor Nick Ariniello said, “the indications are that there isn't going to be a major shift from commercial value to residential value in terms of the rates and so they're they're looking relatively stable right now” - he is Speaker 3 and this statement starts at the 18:07 mark in the transcript;

In February, the Wu administration issued a statement from Mr. Ariniello in response to BPI’s report ‘The Fiscal Fallout of Empty Offices’ that said in part “we don’t feel that the current real estate environment is going to lead to budgetary concerns;”

In April, Mayor Wu called that same report from BPI “false information” during her budget speech.

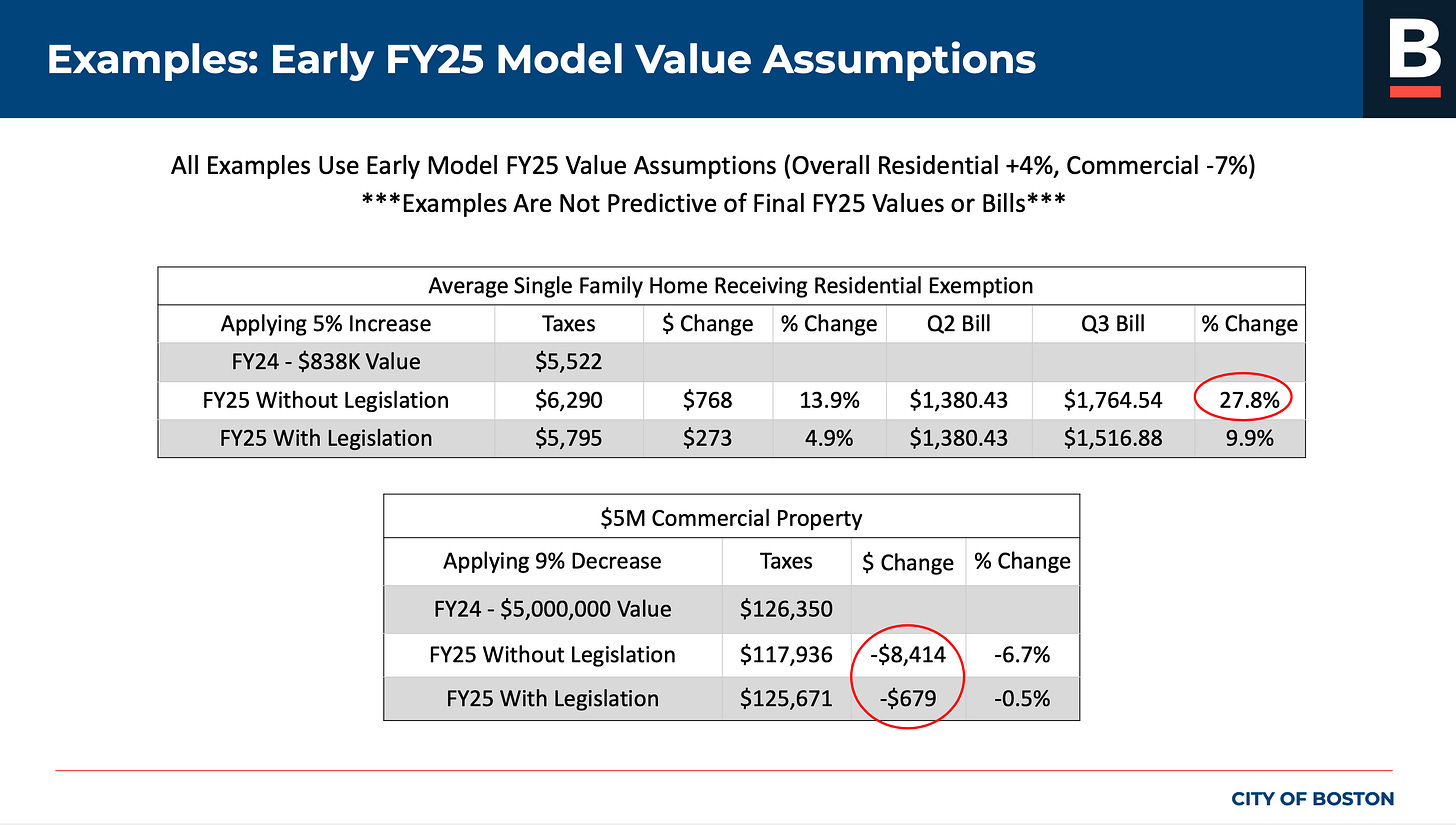

ESTIMATED QUARTERLY TAXES were presented at Wednesday morning’s press briefing where Mayor Wu and Boston’s CFO & Treasurer-Collector Ashley Groffenberger presented “the first high-level citywide projections from the City’s Assessing Office,” or put in plain terms: FY25 estimated quarterly taxes. The briefing appeared prompted by this 17F request from District 2 City Councilor Ed Flynn who requested this information using exactly the same language - check out that 17F request here, and the estimated tax slide below:

Unfortunately, neither the rest of the slide deck or press coverage described the math behind these numbers. For example, the estimated FY25 tax rate per thousand dollars of values under the two scenarios is not provided - that would help other property owners use this slide to estimate their own tax burden. It also isn’t clear why the top of the slide says that this assumes a 7% drop in commercial property values at the top, but the example commercial property gets a 9% drop in value.

BUDGET CUT INSTEAD OF TAX HIKE Globe columnist Larry Edelman focused on Mayor Wu’s answer Wednesday morning about what would happen to Boston’s budget if her tax hike was a budget cut instead - something suggested by BMRB & the Greater Boston Chamber of Commerce:

“Wu said City Hall would need to cut its $4.64 billion budget by $265 million, or nearly 6 percent, to have the same impact as her property tax plan. That would force a layoff of 2,200 city employees and cuts to essential services.”

As a reminder, when Mayor Menino proposed this same commercial tax hike back in 2003, he first cut tens of millions of dollars from the budget and laid off hundreds of City employees. Read the whole column here.

DEADLINE FOR STATE ACTION? Boston’s City Council must approve the tax rates at the end of each calendar year and then tax bills are sent to property owners. The state legislature needs to take action before that meeting - set for “Late November 2024” according to this week’s presentations - or residential property tax payers will get those higher bills:

This is more of a suggestion than a hard deadline: the new tax rates approved by the Council this November won’t hit until Q3 of 2025. Back in 2004, the state legislature missed this deadline, so tax bills went out with the higher rate before Mayor Menino’s proposal passed in January of that year and lowered residential property tax bills.

MCAS RESULTS & BALLOT Q AND BUS PERFORMANCE GET UPDATE & ED SECRETARY WEIGHS IN

Here are the updates on MCAS - both BPS performance & public officials positions on Question 2, which seeks to end the MCAS graduation requirement:

On Tuesday during Mayor Wu’s monthly appearance on Boston Public Radio Jim Braudy asked Mayor Wu about Question 2 and she declined to take a position.

On Wednesday night, School Committee member Brandon Cardet-Hernandez asked the School Committee to weigh in on Question 2, pointing to the debate the Worcester School Committee had. After no other members expressed interest in a conversation, Chair Jeri Robinson declined his request, and SCM Cardet- Hernandez said that he opposed Question 2.

Also on Wednesday, Superintendent Mary Skipper talked about BPS’ MCAS results, and it showed that only 27% of BPS students in grades 3 through 8 are proficient in reading.

BPS’ late buses were also a topic this week, with a new update on how BPS is doing, and a mention of the issue by MA’s Education Secretary on a Sunday public affairs show:

At Wednesday night’s meeting, BPS revealed that the district’s average on time performance - 89% on-time in the morning, and 78% on-time in the afternoon - those afternoon numbers are the subject of an information request from the Boston City Council

On the Sunday Oct 6 episode of Keller At Large , MA’s Education Secretary Patrick Tutwiler talked briefly about BPS’ late buses, following up a written statement he made several weeks ago.

Listen to the Shah Family Foundation’s Last Night at School Committee for a great summary of what happened at this week’s meeting.

4 REPORTS SHARE THE SAME CONCLUSION: COST OF HOUSING IS HIGH

The last two weeks saw four reports either released or the focus of in-person events:

Pioneer Institute analyzed how implementation of the MBTA Communities Act was going and found mixed results three years after it passed and in the wake of this week’s arguments about the law before the SJC;

Massachusetts Budget & Policy Center’s Housing Analyst Victoria DiLorenzo “looks at how much of that $5.16 billion will actually be invested, and how those investments compare to prior years,” according to MassBudget;

Massachusetts Taxpayers Institute released its “Competitiveness Index” back in September, and this week presented it on Wednesday morning alongside at an event organized and hosted by the Greater Boston Chamber of Commerce - watch the event here - one big takeaway: the cost of housing was a major drag on MA’s economic prospects;

Boston Indicators, the Boston Foundation’s in-house think tank, released a report titled “Legalizing Mid-Rise Single Stair Housing in Massachusetts” written in coordination with the Joint Center on Housing Studies at Harvard and local design firm Utile. This is a deeply in-the-weeds issue, but it is vitally important to achieve the gentle density and in-fill development that Boston & other MA cities and town centers need to overcome the housing supply crisis. The report was presented on Thursday morning and featured a panel discussion worth listening to - the video isn’t currently available, but this is an issue that will come up again.

Boston Policy Institute, Inc is working to improve the public conversation - help us by following BPI on YouTube, TikTok, Facebook, Instagram, Threads, Twitter, and LinkedIn.