TODAY: In tax hike filing, Mayor Wu calls current decline in office values “short term” as Council receives home rule to raise commercial taxes over state-mandated limit

Boston CFO’s comments on NBC10’s @Issue and paperwork filed for the Council’s Wednesday meeting shed more light on Mayor Wu’s new tax proposal

Last week, Mayor Michelle Wu proposed a home rule petition that would allow the City of Boston to tax commercial and industrial properties above the state-mandated limit, which she said was necessary to prevent either serious budget cuts or a large increase in residential property taxes. More details have emerged since the announcement:

On Sunday on NBC10’s @Issue, Boston’s Collector-Treasurer & CFO Ashley Groffenberger appeared with Boston Policy Institute, Inc’s Executive Director Gregory Maynard and answered questions about the tax increase and BPI’s report on how declining office values could affect Boston’s budget; and

The home rule petition was filed by the Wu administration in advance of Wednesday’s regular City Council meeting and is preceded by a letter from Mayor Wu that includes a line calling the current office values decline “the short term challenges of certain parts of the commercial office sector,” a perspective that BPI, along with local and national media reporting and market analysis, disagree with.

MAYOR WU DESCRIBES OFFICE VALUE DECLINE AS “SHORT TERM” IN COUNCIL FILING FOR PROPOSED TAX INCREASE

This week, details emerged on one of the major topics of Sunday’s show - Mayor Wu’s proposal to increase commercial property taxes over the state-mandated limit - when the paperwork for Wednesday’s City Council meeting was published - the home rule petition is docket #0642 and starts on page 28 of the agenda packet for Wednesday’s meeting.

One phrase stands out in Mayor Wu’s letter: “the short term challenges of certain parts of the commercial office sector.”

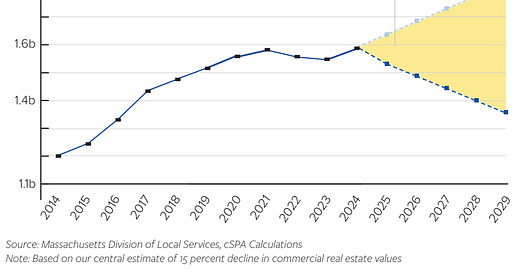

As a reminder, the BPI & the Center for State Policy Analysis at Tufts University ‘The Fiscal Fallout of Boston’s Empty Offices’ report does not conclude that the current challenges faced by the commercial office sector are short term - this chart from our report illustrates the point:

BPI’s evidence is laid out in page 7 of the report:

“We can build off existing work by analysts at McKinsey and elsewhere suggesting that office values are likely to decline 20 percent to 30 percent (or more) in real terms by the end of the decade, which in Boston would propel a 12 percent to 18 percent decline in commercial real estate prices. We estimate that between 2025 and 2029, the city will face a cumulative tax shortfall of $1.2 billion to $1.5 billion, compared with the long-term trend. The annual gap over this window is not constant but slowly expanding as the new reality of commercial real estate trickles through the appraisal process and into the tax system.”

While the letter that precedes the home rule petition lays out in detail how Mayor Wu and her administration broadly see the current post-COVID economic moment and the challenge of falling office values, there is not an explanation for why they think the current fall in office values is short-term. Here are the highlights from her letter:

The specific challenge that this home rule petition is trying to solve is “an automatic jump in residential real estate taxes in order to fully fund City services.”

Mayor Wu believes that the home rule petition is necessary to meet a specific issue, writing: “our objective is that future bills for all property tax payers – residential and commercial – are as comparable as possible as those from recent years.”

She references Mayor Thomas Menino’s successful use of similar language in a bill passed in 2004 that allowed Boston to avoid a shock to residential tax payers - WBUR has more on how the economic situation in 2004 was significantly different than in 2024, with a healthy and growing office sector fueled by the recent completion of the Big Dig and the then-unbuilt Seaport District still to be constructed.

There will be at least two opportunities in the near future for the Wu administration to lay out its evidence and analysis: the upcoming hearing on this home rule petition and at the Ways & Means Committee when they take up Councilor Brian Worrell’s recent hearing order on commercial property tax revenue.

SUNDAY SHOW SHEDS LIGHT ON BUDGET ISSUES AND TAX INCREASE

On Sunday, BPI’s Executive Director Gregory Maynard was on NBC10’s @Issue with the City of Boston’s CFO Ashely Groffenberger to talk about BPI’s report on the fiscal impact of office vacancies on Boston and Mayor Wu’s proposed solution to the issue: increasing commercial taxes. As Politico’s Massachusetts Playbook noted on Monday, CFO Groffenberger said: “I do think there are challenges. And again, [that’s] exactly why Mayor Wu [is] putting forward the measure that she put forward.” Here is a clip from Sunday’s show:

You can watch the whole segment on BPI’s YouTube channel or Instagram page.

IMPORTANT LINKS FROM THIS POST:

NBC10’s @Issue episode from March 31, 2024 featuring Boston’s CFO and BPI’s Executive Director

BPI & the Center for State Policy Analysis at Tufts University ‘The Fiscal Fallout of Boston’s Empty Offices’ report

Agenda Packet for today’s City Council meeting - the home rule is docket #0642, the letter from Mayor Wu starts on page 28, and the home rule petition starts on page 30

Boston Policy Institute, Inc is working to improve the public conversation - help us by following BPI on YouTube, TikTok, Facebook, Instagram, Threads, Twitter, and LinkedIn.

Is anyone acknowledging that residential property values in boston are skyrocketing while the financial district tanks which should lead to increased assessments for those homes that help close the projected billion dollar gap?