Prepare for Boston's Tax Shift Hearing: Will the Council make Changes?

BPI looks at 3 changes the Council could make to the tax shift HRP

The new home rule petition (HRP) that Mayor Wu sent to the Boston City Council on October 25 is a lot different than the original version that the same body approved back on June 5, but both pieces of legislation share something in common: the City Council played no role in negotiating them. Now, the Council has a chance to make major changes to the HRP and the broader budget debate.

This past June, the Council approved the Mayor’s original home rule petition with no changes. Then the HRP went through two rounds of intense and widely reported negotiations, first between the Mayor and State House leadership in July and then between the Mayor and a group of business & policy organizations in October, in which no Boston City Councilor played any reported role.

Here are two examples:

In the September 26 meeting hosted by State Senate President Karen Spilka there were Senators, the Mayor and her aides, and a number of business and policy leaders, but no Boston City Councilors - neither the Globe or Herald (or any other outlet) reported that a City Councilor was in the room.

Last Thursday, Politico MA Playbook author Kelly Garrity wrote a blow-by-blow account of how the tax shift deal between Mayor Wu and a group of business & policy organizations came together - the Council was only mentioned at the end, after the deal was done.

Now that the result of those negotiations - the HRP in Docket #1612 - has been sent to the Council, the body has an opportunity to make changes. While reopening the 182% vs 181.5% argument is likely a deal breaker, it seems clear that Mayor Wu, the legislature, and the business community are all open to small-bore policy changes.

Reading through emails between the Wu administration & business community detailing the October negotiations, and a public proposal by the Councilor leading tomorrow’s hearing, BPI has found three potential additions to the current HRP that were left on the cutting room floor.

Each one could satisfy a different, unmet need:

PROMOTE NEW CONSTRUCTION: The Wu administration offered the leaders of four business and policy organizations the opportunity to collaborate on how to spend $50M of the Mayor’s recently announcing “Housing Accelerator Fund” - something Councilor Worrell has expressed a keen interest in - in Clare Kelly’s 10/15/24 email to Group of 4

IMPROVE BOSTON’S BUDGET CONVERSATION: The Wu administration offered the leaders of four business and policy organizations a chance to join a new task force on diversifying City revenue sources - a topic that multiple Council dockets focus on - in Clare Kelly’s 10/15/24 email to Group of 4

CREATE A “SMALL BUSINESSES EXEMPTION”: Adopt Massachusetts General Law 59, Section 5I (M.G.L. c. 59, § 5I) that allows local municipalities to opt into an exemption that would provide financial relief of up to 10 percent of their assessed value for small businesses valued under $1 million with a maximum of ten employees - Proposed by District 1 City Councilor Gabriela Colleta Zapata in Docket #0925

This HRP is very likely the last time that the Council will have an opportunity to make a substantive impact on the City’s budget debate until next April, when the FY26 budget process begins. Keep reading for more on each change.

PROMOTE NEW CONSTRUCTION

The first two changes were raised during negotiations between the Wu administration and a group of four business and policy groups in October. During those negotiations, Boston's head of intergovernmental affairs, Clare Kelly sent a list of seven points that she wrote were offered “as a way to move our home rule petition forward.”

Five of those points are in the current HRP but the last two were left out of the final deal:

Lower the cap even further to 185% in 2025 185% in 2026 and 180% in 2027 (had been 200% originally)

Remove the trigger window of 3-years to use it or lose it, requiring the predictability that we will use this in 2025

Keep House language of $45M set aside for small business protections

Keep House language of shrinking step-down window from 5 years to 3 years

Keep House language of tripling the small business personal property exemption

Collaborate on criteria for $50M deployment of additional reserves for private projects through Housing Accelerator Fund to complement Momentum Fund

Start joint task force on diversifying City revenue sources

Point #6 is focused on one of Boston’s big problems: 30,000 housing units have been permitted, but are not under construction. The “Housing Accelerator Fund” is intended to help with that backlog and was announced by Mayor Wu at her appearance in September before the Greater Boston Chamber of Commerce. Here is how the Boston Globe described it in article:

To help jump-start stalled residential construction in Boston, Mayor Michelle Wu is launching a long-awaited “housing accelerator fund” that would offer up to $100 million in city funds for equity investments in certain multifamily projects.

The “Momentum Fund” was described in the same article:

Wu said she hopes that her program could complement the state’s new Momentum Fund, a $50 million revolving fund with a similar goal created by the state’s new $5 billion housing bond act.

Marty Walz, the Interim President of the Boston Municipal Research Bureau and one of the four leaders that the Wu administration was negotiating with, wanted Kelly to clarify this point, writing: “Is this $50M in addition to the $100M the Mayor announced at the Chamber breakfast or is the fund now expected to be $50M instead?” Kelly’s response was vague, but it indicated there was no additional money.

This offer from Mayor Wu’s team should attract the interest of District 4 City Councilor Brian Worrell, who held a hearing earlier in October about his own proposal to kick-start home-building in Boston with a $150M development fund. Councilor Worrell criticized the Mayor’s proposed fund at that hearing. Here is what the Boston Globe wrote:

Worrell, though, pushed back [against the Mayor’s proposal] and pointed to several different scenarios he had proposed that included more opportunities for homeownership. He said he had a Boston-based minority-owned development firm review the options, running them through financial models, which found them to be financially viable for the city.

It would be difficult to add language about City-controlled development funds to this home rule petition. However, Councilor Worrell could ask Mayor Wu for a deal similar to the one House Ways & Means Chair Aaron Michlewitz got in July: a promise to take additional action in exchange for his support.

That was how Mayor Wu got her original HRP through the House back in July. Here is what the Globe wrote:

But a breakthrough came when Wu agreed to use her executive powers to make changes to some of the measure’s components at a later date if the bill is ultimately passed . . . The deal worked with Representative Aaron Michlewitz of Boston, chair of the powerful House Ways and Means Committee, would require Wu to change the tax plan via executive order should the legislation become law.

As a reminder, the current HRP supersedes that July agreement, and the changes that Mayor Wu’s promised to implement via executive order were written into the HRP.

IMPROVE BOSTON’S BUDGET CONVERSATION

For the last several months BPI has been calling for an inclusive, transparent, and data-driven conversation about the unique budget challenges Boston is facing and the last point sent in the email from the Mayor’s team is a version of that.

Here is what Kelly wrote:

Start joint task force on diversifying City revenue sources

This point appears to have been dropped from negotiations at the request of Marty Walz, the Interim President of the Boston Municipal Research Bureau, who wrote:

“As some on the Mayor's team know, the Research Bureau is working on a report about revenue diversification. We expect to publish that in the coming weeks. Revenue diversification is going to be difficult to achieve given the city's heavy reliance on property taxes. Our report may affect your thinking on next steps, so I want to be sure you're up to date about our work on this.”

While this “joint task force” didn’t make it into the deal announced last week, the Council has offered three actions that could foster the same conversation:

Docket #0485, a resolution that would establish “a blue ribbon commission to study strategies in filling downtown office vacancies,” which was offered by District 2 City Councilor Ed Flynn and approved 12-0 by the City Council at their March 6 meeting. You can read more about the resolution in this Herald article written when it was offered and it got a new update from Boston Globe business columnist Jon Chesto when Councilor Flynn sent a letter to Boston’s planning officials in July. So far the Mayor has not appointed the commission.

Docket #0479, a hearing order offered by District 4 City Councilor and Ways & Means Committee Chair Brian Worrell that seeks to “discuss projected commercial property tax values in Boston,” which was also offered at the Council’s March 6 meeting. Despite this hearing order being sent to Councilor Worrell’s own Ways & Means Committee, he has not held a hearing on it yet.

Docket #0999, a hearing order to discuss “ways to diversity the City of Boston’s revenue,” offered by District 3 City Councilor John FitzGerald, District 7 City Councilor Tania Fernandes Anderson, and Councilor-At-Large Julia Mejia back on June 12. It was sent to the Ways & Means Committee, but a hearing has not yet been held.

A substantive public conversation about the budget crisis facing Boston and how to fix it requires the cooperation of a lot of people and groups, nearly all of whom have taken an active interest in the current HRP. With the HRP currently before their body, the Council’s leadership has an opportunity to be the catalyst for that conversation.

CREATE A “SMALL BUSINESSES EXEMPTION”

The final change is also the only one that can simply be added to the existing home rule petition by the City Council.

Not only would this change be straight-forward to add, the Councilor who proposed it back in July is also in a position to do it: Government Operations Committee Chair & District 1 City Councilor Gabriela Coletta Zapata. She is chairing tomorrow’s hearing, and as the Chair is in control of the HRP’s fate.

Here is the change that Councilor Coletta Zapata first proposed in an op-ed in the Dorchester Reporter written back in July:

“I oversaw the review and passage of this proposal as chair of the Government Operations Committee of the Boston City Council earlier this spring. Simultaneously, I made a commitment to find a way to leverage a “carve out” that would financially bolster our local businesses . . . Existing Massachusetts General Law 59, Section 5I (M.G.L. c. 59, § 5I) that allows local municipalities to opt into an exemption that would provide financial relief of up to 10 percent of their assessed value for small businesses valued under $1 million with a maximum of ten employees.”

She added a few paragraphs later:

Understanding that the state law opt-in, as it currently stands, might not fully meet the moment as many commercial properties in Boston are valued over the one million dollar threshold, I am also working on increasing the maximum assessed property value allowed to $2 million, $3 million, or even $4 million to ensure that more small businesses are eligible for this exemption in Boston.

Reading that op-ed and reading the transcript of the hearing about it back in July, it seems clear that Councilor Coletta Zapata’s “small business exemption” shares a lot of similarities with Section 3 of the current home rule petition.

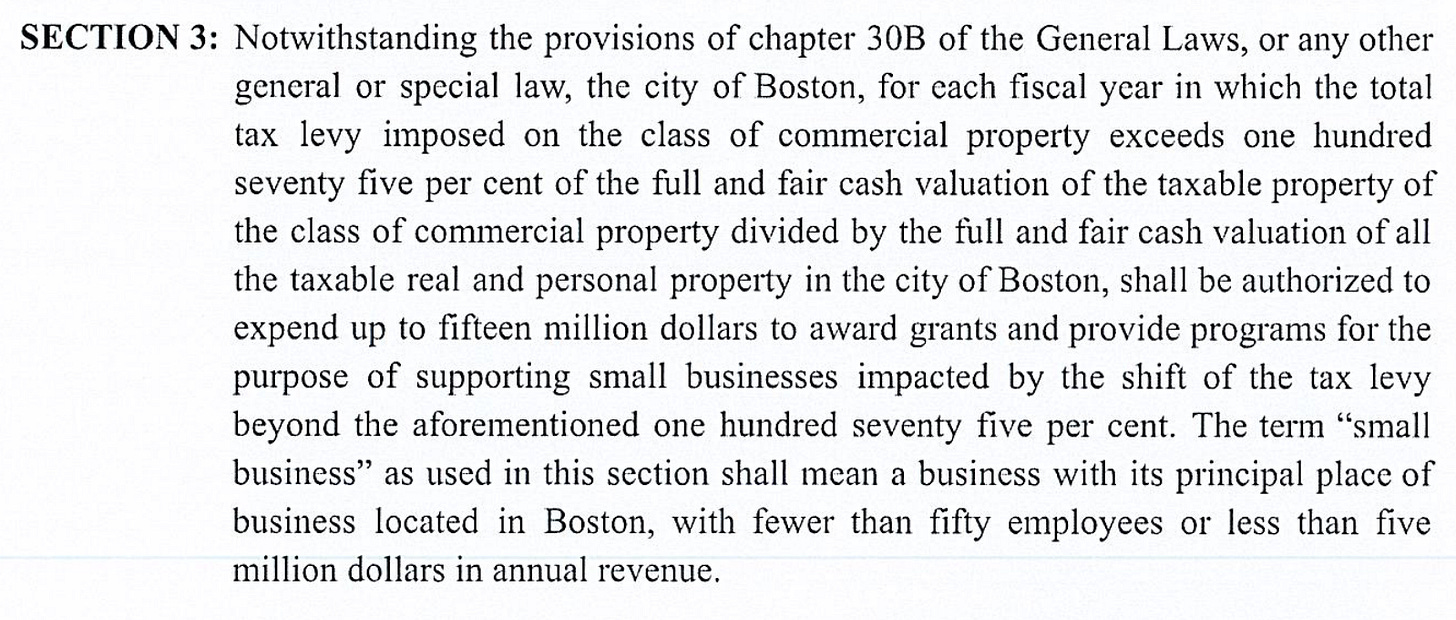

Here is that section of the HRP:

Section 3 as currently written was added to the mix by House Ways & Means Chair Aaron Michlewitz as part of the deal that allowed the original version of the HRP to pass the House back in July.

Here is how the BBJ described it when it was announced back then:

[Mayor Wu] also said it would direct the city's chief financial officer to seek appropriations of $15 million per year in each of those three years to support small businesses. According to Michlewitz, those "tax protections" will be limited to employers with 50 workers or fewer or an annual revenue of less than $5 million. The city will also move to expand a personal property tax exemption for small businesses.

Chair Michlewitz’s “tax protections” in July have now turned into “awarding grants and providing programs” in October. Despite the language change, the amount of money - $15M/year for the 3 year life of the temporary tax shift - and intended recipients - Boston-based businesses with 50 employees or fewer or an annual revenue of $5M or less - have remained the same.

The home rule petition has no details about how “awarding grants and providing programs” would work, and the Wu administration has not released any further information. The lack of detail in other grant making processes has led to a series of clashes between Councilors and the Wu administration this year, most recently over the last $7M in ARPA money.

While Councilor Coletta Zapata’s proposal is much more detailed, it too has met with criticism. Boston CFO Ashley Groffenberger expressed her opposition to the proposal at the July 9 hearing on the issue. In this clip, Groffenberger explains why implementing it would be so difficult - Groffenberger is Speaker 2 and she begins speaking at the 29:36 mark in the transcript:

Watching Groffenberger’s explanation raises real questions about how much City Hall actually knows about Boston’s small business community. Specifically, it is not clear how City workers would get the information to know that they were “awarding grants and providing programs” to businesses that were eligible.

Apart from the pros and cons of this particular policy, Boston currently faces a years-long budget crisis, with neighborhood business districts and downtown office towers facing vastly different issues that make a clear understanding of Boston’s small businesses more important that ever.

The lack of detail in Section 3, plus the clear and oft-stated desire among Boston City Councilors to help small businesses avoid any negative impact from a tax shift aimed at downtown office towers, makes this switch a real possibility.

The City Council’s hearing on the HRP is on Tuesday, October 29, at 11 AM. Right now the hearing is in-person at City Hall. Check out all the details about the hearing here, and make sure to sign up for BPI’s email list & follow us on social for more!

Boston Policy Institute, Inc is working to improve the public conversation - help us by following BPI on YouTube, TikTok, Facebook, Instagram, Threads, Twitter, and LinkedIn.

Boston is spending $171 million to transport 22,000 students. That is $7,700 per student. I do not know how the legislature can take any proposal seriously when the Mayor’s office shows no sense of fiscal responsibility.