5 Questions for Thursday's Council hearing on Revenue

BPI hopes to hear more about revenue projection details, tax shifts, PILOT payments, Prop 2 1/2, & publishing property tax estimates this fall

At 10 AM on Thursday morning the Boston City Council’s Ways & Means Committee is holding its 3rd meeting on Docket #0325 “a hearing regarding the City's FY26 budget, specifically FY26 revenue,” which follows a working session held on February 10 and a public testimony session held on February 18. Revenue is a major issue in Docket #0325, with the authors noting in the hearing order:

FY25 marked the highest share of the property tax levy paid by residential property owners and the lowest share paid by business property owners in at least four decades.

Boston’s FY26 budget won’t be formally released until April, so not only is this hearing the first time that City Hall budget writers will answer questions from the City Council about the FY26 budget, Thursday’s action could have an impact on the final version.

With all that in mind, BPI put together five questions about revenue.

5 QUESTIONS FOR CITY HALL BUDGET WRITERS

For more potential questions, check out the Request-for-Information (RFI) that City Councilors put together at their February 10th working session, and check out the preview & weekly round-up BPI wrote about the 2024 revenue hearing the Council held during their formal budget season.

QUESTION 1: Boston’s budget surplus have been much higher under the Wu administration - $176M in FY24 and $192.6M in FY23 - than under Mayor Walsh’s administrations in the three years prior - $29.3M in FY22, $15.3M in FY21, and $15.3M in FY20. Did something change in how Mayor Wu’s administration calculates its revenue? In FY25 and the following years does the City think that large surpluses will continue or return to the lower prior years?

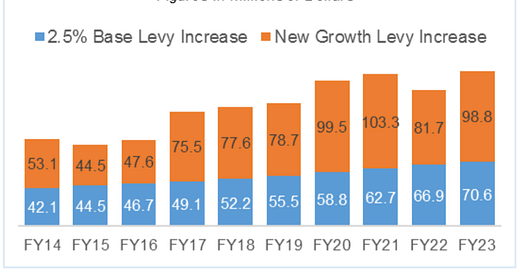

FOLLOW-UP: One source of that surplus revenue is that Boston has seen significantly more new growth than anticipated. The City’s last three budgets - FY23, FY24, and FY25 - all projected that Boston would see $60M in new growth, but the real numbers were significantly higher: $98.8M in FY23, $121.8M in FY24, and $90.5M in FY25. Can the City walk through how it calculates new growth?

QUESTION 2: According to Docket #0325, FY25 marked the highest share of the property tax levy paid by residential property owners and the lowest share paid by business property owners in at least four decades. Does the City think that this shift is a one-time event, or does the City expect that this shift will continue over the coming years as the value of office towers continues to fall?

QUESTION 3: Last year City Hall budget staff said repeatedly in hearings and in newspaper pages that property taxes must be raised to the maximum amount allowed by Proposition 2 1/2 every year in order to maintain the City’s credit rating and pay for basic city services. This past November the Boston Municipal Research Bureau released a report titled “Diversifying Boston’s Revenue” that proposed a number of potential new revenue sources, and additional sources of local revenue have recently been proposed by Governor Healey and by City Councilors, including a sugary beverage tax from Councilor Durkan. Are any of the proposed revenue sources reliable enough that if the City were allowed to collect that levy that sort of tax, property taxes would not need to be raised to maximum amount allowed by law? If none of these sources are reliable enough, can the City talk about what they would need to see from a revenue source in order to consider not raising property taxes the maximum allowed by law?

FOLLOW-UP: In emails sent last fall between business groups and the City Hall officials during negotations over Mayor Wu’s tax shift proposal, one of the items under discussion was “Start joint task force on diversifying City revenue sources,” which appears to have been dropped at the request of Marty Walz, the Interim President of the Boston Municipal Research Bureau. Is the City still considering launching this task force on revenue?

QUESTION 4: Last July Boston Globe columnist Larry Edelman reported that Mayor Wu was seeking higher PILOT payments from the City’s non-profits, writing at the time that City Hall was “optimistic a deal can be struck that would increase payments starting in 2025.” In the 7 months since there have been a few press reports but no deal has been announced. Can the City explain why the 2024 PILOT report has not been released or provide an update on negotiations?

FOLLOW-UP: Earlier this month Boston Globe columnist Shirely Leung wrote a column titled “Trump is coming for ‘eds and meds.’ That’s a big problem for Massachusetts,” and detailed how important hospitals and universities are to the Commonwealth’s economy. In light of the problems highlighted in that column, plus other signs of distress in ‘meds & eds’ related sectors like Steward Healthcare’s bankruptcy and layoffs and Mass General Brigham is the City rethinking its approach to PILOT payments?

QUESTION 5: In 2024 the City of Boston created estimated property tax rates that were presented to State Senate President Karen Spilka in September and released to the public in October as part of Mayor Wu’s effort to get her tax shift proposal passed on Beacon Hill. Will the City committ to creating estimated property tax rates and release those estimates in September?

Boston Policy Institute, Inc is working to improve the public conversation - help us by following BPI on YouTube, TikTok, Facebook, Instagram, Threads, Twitter, and LinkedIn.